Is the Real Estate Market in Jacksonville Crashing?

Jacksonville Fl Real Estate Market Report September 2022

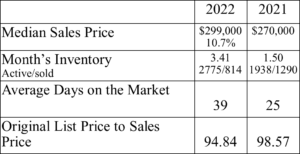

Couple things to look at. See chart below. Median sales price came down by 1k from August 2022, but still up by 10% compared to last year in September. Inventory levels, which is an indicator of supply and demand. Demand has continued to go down since July 2022. We are still in a seller’s market. A balanced market is around 3-6 months, we are at 3.41 months. Not far off from a more balanced market, but no crash here. 2022 won’t see a crash. 2023 is still up in the air. Interest rates, continued higher inflation will be factors. Higher rents could keep us from crashing, because buying can still be less per month than renting. You might be wondering if these numbers apply to your home, but each neighborhood is different, so if you’re thinking of selling and want to know more click:

If you’re a buyer and want to see what homes are available in Jacksonville, click the following link: Want to Search for Homes in Jacksonville Florida?

Median Sales Price: Looking at sold homes it means that half the homes that sold were more than 299,000 and the other half were less than 299,000.

Month’s Inventory: Based on the number of actives and homes that have sold it would take 3.41 months to sell the active homes, if no other homes came on the market. How to determine what type of market we are experiencing:

Buyers’ Market: More than 7 months of Inventory

Balanced Market: From 5-7 months of Inventory

Sellers’ Market: Less than 5 months of inventory

Average Days on the Market: This is the average based on the time the house came on the market until is went under contract.

Original List Price to Sales Price: This is the percentage of what the home sold for compared to what it was originally listed for. Not what it was listed for at the time it went under contract.

What’s my Jacksonville Florida Home Worth?