Jacksonville Fl Real Estate Market Report April 2020

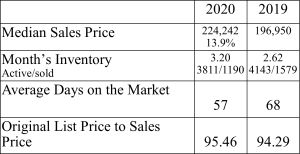

As I promised last month, I am doing this real estate market report for Jacksonville a little earlier than normal. The only negative for April, was the number of homes sold, which was 1,190. A difference of 389 homes LESS that sold last month, compared to April 2019. If we look at the big picture, that’s not too terribly bad. All the other stats were good.

Now, let’s look at May currently, as of the 14th. We have 311 homes so far. That’s about 22.21 homes sold a day. If we use that figure for the rest of the month, we will sell about 688.51 homes. Which will be about 1,017 less homes sold in Jacksonville for May 2020, vs May 2019. Obviously, there are variables that will cause the math not to be so even each day, but you get the idea. So far the median sales price is up by 15k for the month of May (2020). That’s even with less homes sold. I don’t see any other negative numbers for May, except the number of homes sold.

I see many agents trying to predict what’s going to happen with the market. No one can really predict what’s gonna happen, since this is new territory. There’s too many factors and unknowns that we have to see play out. Here’s some scenarios I see that will need to be addressed or played out:

- Will we have a 2nd wave and be “shut down” again?

- Home owners who have done a forbearance, there is speculation that it could have a negative impact on their credit. Continuing with forbearance, some home owners are not prepared to pay back the 3 payments in full after the 90 days. That could result in late pays showing up on their credit.

- How will lenders deal with a lapse in pay for non-essential folks? Whether they were able to receive unemployment or not?

- How will lenders handle sellers who had late pays and forbearance on their credit?

There’s more I’m sure that I haven’t thought of. Seller’s nervous about people coming into their homes while they live there. Buyer’s waiting to see if prices come down, etc.

You might be wondering if these numbers apply to your home, but each neighborhood is different, so if you’re thinking of selling and want to know more click:

If you’re a buyer and want to see what homes are available in Jacksonville, click the following link: Want to Search for Homes in Jacksonville Florida?

Median Sales Price: Looking at sold homes it means that half the homes that sold were more than 224,242 and the other half were less than 224,242.

Month’s Inventory: Based on the number of actives and homes that have sold it would take 3.20 months to sell the active homes, if no other homes came on the market. How to determine what type of market we are experiencing:

Buyers’ Market: More than 7 months of Inventory

Balanced Market: From 5-7 months of Inventory

Sellers’ Market: Less than 5 months of inventory

Average Days on the Market: This is the average based on the time the house came on the market until is went under contract.

Original List Price to Sales Price: This is the percentage of what the home sold for compared to what it was originally listed for. Not what it was listed for at the time it went under contract.

What’s my Jacksonville Florida Home Worth?

Homes for sale in Northeast Florida: