Jacksonville Fl Real Estate Market Report July 2022

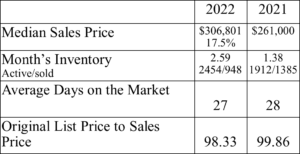

Still no crash. There, no playing games with your emotions. 🙂 There are changes tho. There’s 500 more homes on the market in July, compared to June. There’s less homes that sold, almost 300 less, which makes the months inventory levels around 2.59 months. So, we are almost at 3 months worth of inventory, which is STILL a seller’s market. Prices are still rising, but not at the crazy amount we’ve been seeing the past 12 months or so. June saw the median sales price in Jacksonville come down by about 5k. July dropped as well, but median prices are still higher in 2022, compared to 2021. I think based on the current trend, we will see that change and the numbers start to be similar. What does this mean to buyers? We are still in a seller’s market, but you have more homes to choose from. You may even be able to ask for some repairs, ask for closing cost, not have to waive the appraisal contingency or not have to help the seller move. I’m just kidding about that last part. I don’t think that’s happened. Can you throw a low ball offer out? Of course you can, doesn’t mean you’ll get it in a seller’s market. Sellers, what this means for you is, you can’t just have your home in any condition. Buyers have more choices. It’s still a great time to sell. Will you be able to just throw any price against the wall, and it will stick? Nope. There can still be multiple offers, but your house needs to be nice, and not priced way higher than other homes. Marketing time will take just a little longer, but not crazy long. The days on the market in the chart below, are not changing radically. Overall, the market is changing, but it’s a correction, not a bubble. Can that change? Yes, it can, but right now, we are not seeing that. You might be wondering if these numbers apply to your home, but each neighborhood is different, so if you’re thinking of selling and want to know more click:

If you’re a buyer and want to see what homes are available in Jacksonville, click the following link: Want to Search for Homes in Jacksonville Florida?

Median Sales Price: Looking at sold homes it means that half the homes that sold were more than 306,801 and the other half were less than 306,801.

Month’s Inventory: Based on the number of actives and homes that have sold it would take 2.59 months to sell the active homes, if no other homes came on the market. How to determine what type of market we are experiencing:

Buyers’ Market: More than 7 months of Inventory

Balanced Market: From 5-7 months of Inventory

Sellers’ Market: Less than 5 months of inventory

Average Days on the Market: This is the average based on the time the house came on the market until is went under contract.

Original List Price to Sales Price: This is the percentage of what the home sold for compared to what it was originally listed for. Not what it was listed for at the time it went under contract.

What’s my Jacksonville Florida Home Worth?