One of the questions I get asked a lot when dealing with foreclosures is: Will banks take less than the list price? That’s a good question, because really, everyone wants to get a good deal and save some money. I got to thinking about this question the past couple of days and wanted to actually look to see what the trend has been for 2013. Plus, I kinda like real estate statistics. 🙂

Here’s what I found:

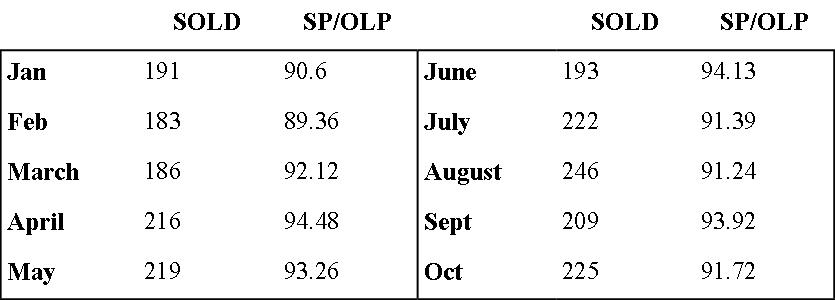

Sold Foreclosures in Duval County

The 2nd column is the number of foreclosures that sold for that month in Duval County. The 3rd column is the Sales price to ORIGINAL list price ratio. I capitalized original, because it’s important. I’ll explain further. Let’s take January, the SP/OLP is 90.6, which means that on average, the 191 foreclosed homes sold in Duval County, they sold for 90.6% of what they were originally listed for. The reason I stressed original, is because some agents will advertise a really high list price to sale price ratio to make it seem that they save their sellers more money. However, some use the list price of the house when it goes under contract, not the price of the home when they first listed it. So if they originally listed it for say 150k, then eventually the price is reduced to say 140k, which generates a full price offer, it could seem they have a 100% sales price to list price, which is not accurate. They actually would have a ratio of around 93%.

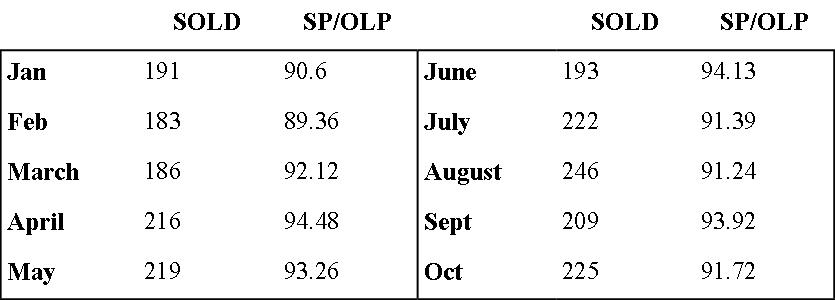

Let’s look at the other two counties:

Sold Foreclosures in Clay County

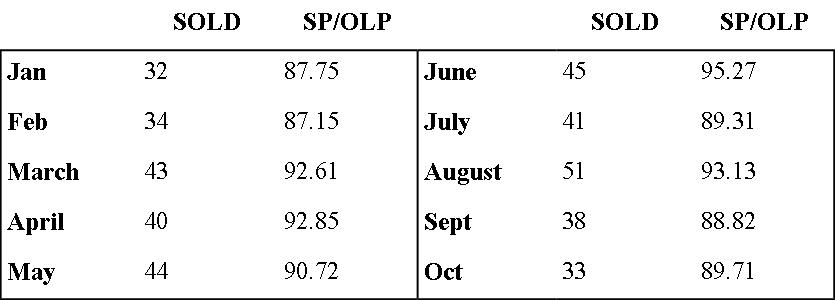

Sold Foreclosures in St Johns County

Now, before you go and get all excited about making a low offer on a foreclosure, stop for a moment to think this through…..

So what does all this data mean? Does it mean that if you come across a foreclosure that is 150k, that you are gonna be able to offer 10% lower? Not necessarily. Here’s some things you want to factor before making your offer. Has the bank already lowered their price? Is this a multiple offer situation? How is the home priced compared to the rest of the neighborhood? Is this home in a desirable neighborhood? How bad do you want this house? Remember, these figures above are ratios from when the house was first listed with that agent, and could have already seen price drops that reflect those SP/OLP ratios above.

I’m not trying to tell you not to offer lower than list price, if you can get the house for less, than that makes me pretty darn happy. I just want you to look at it with an educated view point, so you’re not disappointed with the outcome.

Maybe, you want to look for all available homes in Northeast Florida, whether they are foreclosures, short sales, new construction and resales. If you have any questions or need some help, feel free to shoot me an email at pam@pamgraham.com or call/text me at 904-910-3516.