Will The Real Estate Market Crash in Jacksonville in 2022?

Couple things before we start. Real Estate is local and no one knows what is really going to happen. This  is a very unique situation. We can look at past numbers like , unemployment, inflation, market cycles and other factors to try and gauge the future, that’s what we have to go on. What we don’t have to go on is Covid. It threw a wrench into things that we have never experienced before. When covid first hit, April & May 2020, we saw deals fall through and the amount of homes sold dropped. It made sense to think that was how the year was going to go, but nope. June said hold my beer, and the market was back to normal. I’ve always wanted to say hold my beer, even though I don’t drink. 😁

is a very unique situation. We can look at past numbers like , unemployment, inflation, market cycles and other factors to try and gauge the future, that’s what we have to go on. What we don’t have to go on is Covid. It threw a wrench into things that we have never experienced before. When covid first hit, April & May 2020, we saw deals fall through and the amount of homes sold dropped. It made sense to think that was how the year was going to go, but nope. June said hold my beer, and the market was back to normal. I’ve always wanted to say hold my beer, even though I don’t drink. 😁

Inventory levels started coming down and houses were selling again. I was grateful, but a little surprised. Okay, I was surprised alot. It made more sense that the market would crash.

So, will we see a market crash in Jacksonville?

Based on what I’m seeing with supply and demand, we are not going to see a crash. I really think any market corrections, and yes, there will be market corrections, they will be gradual. It won’t be a year from now and I’m thinking holy mash potatoes batman, we are in a buyer’s market! Now, if I’m wrong, I’ll quietly delete this blog post & video I made. I’m just kidding. I won’t delete them. 😬

Here’s the video:

Here’s why I think it will be a slow process. The biggest factor is sellers not having a place to go due to low inventory. Obviously we will have sellers who have to move. We are a military area, so those folks are coming and going all the time. Many sellers have decided to wait. Some to see how the market will be, and some decided to make their current home their dream home. I think people are still nervous about having others in their home due to covid. If you are a homeowner wanting to sell your home, but are nervous about having people in your house, here’s a blog post I wrote about keeping you and your family safe.

I know you’ve heard about Zillow ending their ibuyer program and are selling off 7000 homes. Many are saying they are doing this because they see a crash coming. Actually, they just made mistakes and got in over their heads. In the grand scheme of things, 7k homes are a drop in the bucket. That’s spread out over 5 major markets. Jacksonville has about 58 of those homes. That’s nothing. Our inventory level is so low, that even if a thousand homes came on the market next month, we would still be in a seller’s market.

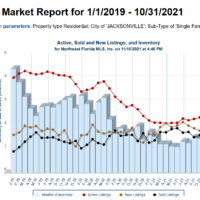

And that right there folks is why I think it will be gradual. There’s just not a trigger to cause a major change, that will cause a crash. Even with people who were in forbearance, that number has dropped. The numbers shared by the mortgage bankers association shows that the numbers are dropping every week. Many owners are choosing to have the amount of forbearance added to the end of their loan and their original payment continuing. Due to the rising prices, many could sell and be able to walk away with equity. Many bigger banks have said they are waiting an additional 12 months before they start the foreclosure process. I did notice the inventory levels from July through October have went up and down. Not huge changes tho.

Update on homes going into foreclosure……. I just read an article yesterday, that talks about how the foreclosure filings went down in November, compared to October, but higher than last year in November. It makes total sense it would be higher this year than last year, due to the foreclosure moratorium in place last year. Jacksonville got a mention, that it was one of the worst foreclosure rates in November 2021. 1 in every 2,733 housing units going into foreclosure. I just went to the Duval Clerk website online and pulled up the Lis Pendens filed in November. There was 102 of them, which include HOAs filing, due to violations. Two things here, 102 filings is so small, that it won’t affect the market and two, I don’t get their math, because 102 filings does not come out to 1 out of every 2,733 households.

The other day in a local group I was reading that a lady was told by real estate agents, that she trusted, that there is going to be a crash, so she was holding off on buying a home. I was stunned. Now, I really feel that we are in unknown territory, so no one really truly knows what’s gonna happen. Even yours truly. However, I run stats every month for Jacksonville, Clay and St John Counties, and I have done this for years. Go ahead and check it out here: Jacksonville Real Estate Market Reports

So, when an agent says that, I have to wonder what they’re basing it on, because they’re not basing it on the current market. I have also read some agents say because of the market crash of 2008. With no explanation on why, juts because of the market crash of 2008. Let’s dig deeper into that. The market actually started to change in July 2005, when inventory rates started to rise. Our inventory levels recently, have been lower than back in 2005. Builders had no issues building homes back then, but now, they are struggling due to supply and labor shortages. Loans were given to anyone with a pulse. Home owners used their homes like atms. There was predatory lending happening. Gas prices were higher back in that time frame, compared to now. Yes, they suck now too. Here’s the other thing too, home owners could walk away from their houses, by doing a short sale or just letting them go, and rent a pretty nice house for less than their mortgage. Rentals were going for about $1,000 to $1,100 on average. Now, those same ones are around $1,600, maybe more. Well, no maybe, there are many that are more expensive. I rented from 2008ish to 2015. A 4 bedroom 2 bath home, 1,800 square feet, neighborhood in Lake Asbury for $1,000 a month. That same house recently rented for over 2k. We just bought a house in July, and it’s about $200 less than the rent we were going to pay when the lease renewed. I know you’re wondering why I brought rentals up, and I’ll explain. Even with the rising prices, the lower interest rates are helping to make the monthly payment lower than renting. So, even current home owners it would make more sense to stay put, than rent a house right now.

I know this was a long read, but it’s one that I’m passionate about. In 2005, I was a couple years into my real estate career and very green still. I didn’t run stats, and couldn’t tell you what the inventory levels were or what inventory levels even meant. Did I mention I was very green? I told a buyer that there was no need to worry about housing prices, they wouldn’t go down. Boy, I was wrong. No one can predict the market entirely, but if you don’t run the numbers every month, and understand them, you have no business talking about them. In this scenario, you is me. 🙄

I ran across a book geared towards real estate agents, and the author talked about marketing stats. It was a light bulb moment. After that, I started running numbers monthly. I’ve changed the formats some over the years, but kept the same concepts.

So, if a real estate agent tells you a crash is coming, ask them how they know that. If the only answer is because of the great crash of 2008, then take it as a grain of salt, and come check out my market reports I do EVERY month. When the numbers change, I will be objective and talk about those numbers.

There will need to be triggers. What will make home owners feel comfortable to sell their homes, and what will cause buyers to stop buying homes? We shall see.

Resources:

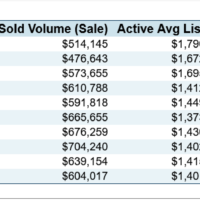

These are the stats I pulled from the Multiple Listing Service for Jacksonville. Single family homes, rentals and sales.

Foreclosure filings as of November 2021: November 2021 Foreclosure filings decline

Share of Mortgage Loans in forbearance declines

📕 Free Guides on the Home Buying & Selling process: 📕

| Free Home Seller Guides |

|---|

| Preparing Your Home To Sell |

| Free Home Buyer Guides: |

|---|

| The Home Buyer Guide |

| Why You Should Use An Agent To Buy New Construction |