50-Year Mortgage vs 30-Year: I Ran the Numbers So You Don’t Have To

I’m sure you’ve heard about the 50 year proposed mortgage option on the table. It has been thrown around with the hopes that it could make home ownership a little more affordable for buyers. My first initial thought was, maybe it could be a tool for some, but there are some negatives like paying more interest and not paying enough of the principle down.

Now steer clear of anyone who has an opinion on the 50 year mortgage based off their hate or love for the President. If you don’t run the numbers and tout or not tout this product, due to love or hate, you are doing a disservice to the public. I ran the numbers and I’ll share what they were, plus share the mortgage calculator I used.

Here’s what I used:

- 400k Price

- 386K loan amount

- FHA Loan which is 3.5% down

- Compared a 30 year vs a 50 year term

- 5.86% was the current FHA rate at the time I wrote this, then added a half percent for the 50 year calculations. The 50 year mortgage will have a higher interest rate than the 30 year.

I used Mortgage Calculator to input my data. I went to Mortgage Daily News to get the latest FHA rate.

Principle and interest payment on 30 year: $2,654.64. 50 year: $2,510.35. That’s a difference of $144.29 per month.

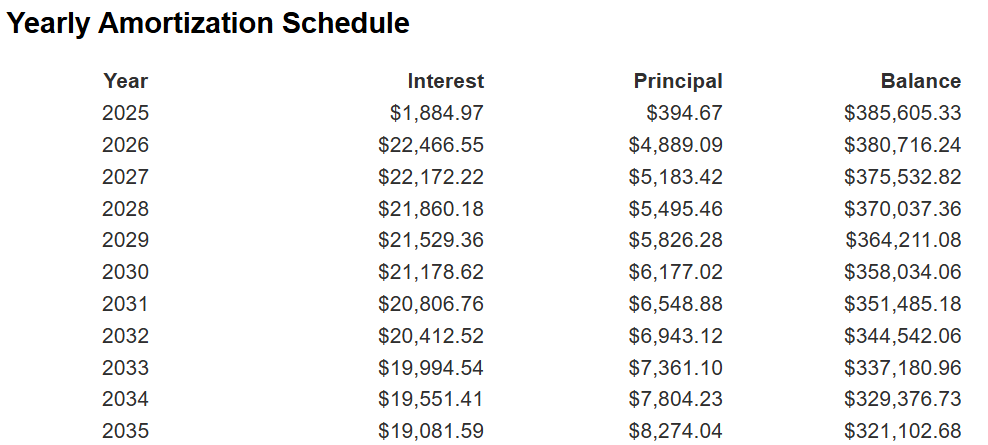

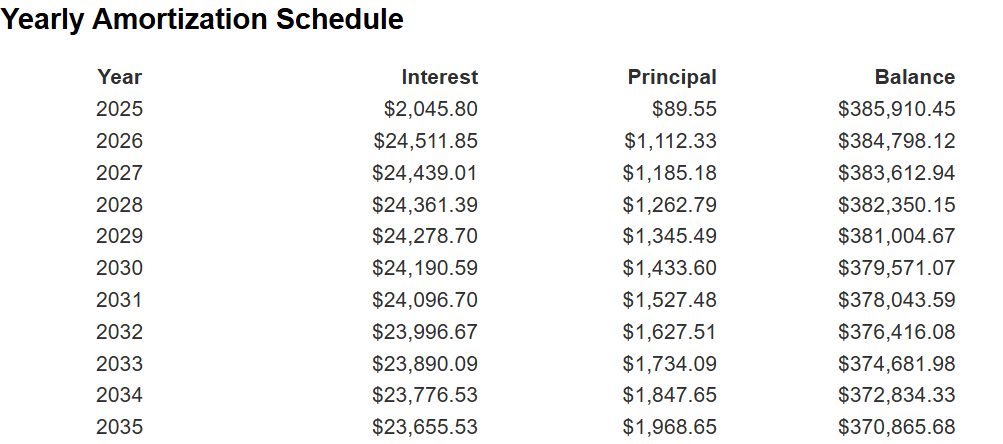

The next two pics are amortization charts just for the first 10 years, because usually people sell or re-finance before then. In my calculation, 2025 is really just one month, so it’s more like 9 years.

30 Year Amortization for first 9 years

50 Year Amortization for first 9 years

After the nine years and 1 month the loan balance for a 30 year mortgage will be $321,102.68 and the 50 year will be $370,865.68. So you will have paid down $64,897.32 towards the 30 year and $15,134.32 towards the 50 year mortgage. Interest paid for the 30 year is $210,938.72 and for the 50 year is $243,242.86. Holy mash potato Batman, both of those numbers are high. The banks are making bank. This is why I never look to see how much I will end up paying in interest after the house is paid off.

So the 50 year mortgage you end up paying $32,304.14 more in an interest to have a payment of $144 less per month than the 30 year. Personally, I don’t think it’s worth it, but what do you think?

What’s some options? Do you need closing cost assistance?

📚 FREE Buyer Ebooks 📚

I’m Pam Graham, a Northeast Florida real estate consultant, which includes Jacksonville, Clay & St John’s Counties. I break down the market in layman’s terms so you can make smart decisions—whether you’re buying, selling, or just keeping an eye on what’s happening.

Call/Text 904-910-3516

Email: pam@pamgraham.com

1 thought on “50-Year Mortgage vs 30-Year: I Ran the Numbers So You Don’t Have To”