The Jacksonville Fl Real Estate Market Update May 2023

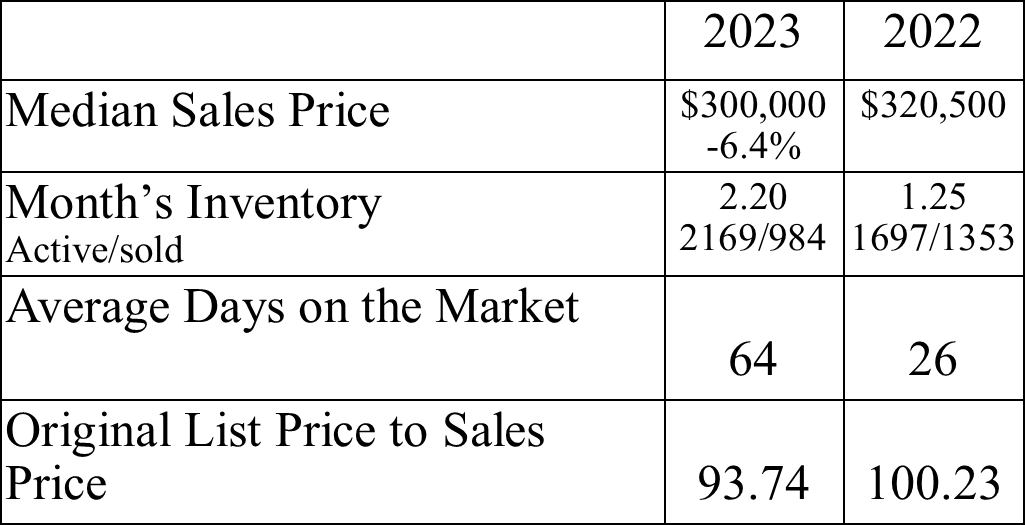

This report will always highlight single family homes, which does not include condos. Condos are a totally different animal, so the stats would not give an accurate picture for single family homes or condos. If you look at the chart below, you will see the median sales price in Jacksonville for May has dropped compared to what it was in May 2022. We actually see it in the negative by 6.4%! Even with that, we are not seeing a crash. If you also look at the chart, see months inventory. That 2.2 is still a seller’s market. You may be wondering, how is the prices coming down, but we are still in a seller’s market? At one time in 2020 to early 2022, we had so few homes on the market and such high demand, due to low rates, that it was an intense seller’s market. The correction we are seeing is just not enough to harm the Jacksonville real estate market right now.

What about the waves of foreclosures coming? In Jacksonville from 1/1/22 to 6/18/22 there were 1,018 foreclosures filed. This year, same time period, there are 1,127 filed, so an increase of 109. Not much of a difference. Corelogic collects data on mortgage delinquencies and as of March 2023, we see a decrease. Here’s a quote directly from the article:

“The U.S. mortgage delinquency rate fell to a historic low in March, reflecting the lowest U.S. unemployment rate in more than 50 years. While a slowing economy could cause increases in job losses and mortgage delinquencies, years of home equity gains will provide borrowers who fall behind on their payments with a cushion. This equity should protect many homeowners from foreclosures. There is no current projection that the U.S. foreclosure rate will reach the same level as it did during the housing crisis more than a decade ago.”

-Molly Boesel

Loan Performance Insights from Corelogic

What’s My Home Worth?

Thinking of selling your home? Click below to complete a form, then receive a market analysis within 24 hours.

Will we see interest rates under 3%?

Median Sales Price: Looking at sold homes it means that half the homes that sold were more than 300,000 and the other half were less than 300,000.

Month’s Inventory: Based on the number of actives and homes that have sold it would take 2.20 months to sell the active homes, if no other homes came on the market. How to determine what type of market we are experiencing:

Buyers’ Market: More than 7 months of Inventory

Balanced Market: From 5-7 months of Inventory

Sellers’ Market: Less than 5 months of inventory

Average Days on the Market: This is the average based on the time the house came on the market until is went under contract.

Original List Price to Sales Price: This is the percentage of what the home sold for compared to what it was originally listed for. Not what it was listed for at the time it went under contract.

Good to know about the Jacksonville real estate market Jessica. That price drop might sway more buyers to consider your city, and with more inventory, you might have one of the better markets. $300,000 is so inexpensive to all homes up here in the north. Good luck for the rest of the summer, and hopefully those mortgage rates will start falling by November.